Blog Layout

Is A Fixed-Index Annuity Right For You?

Admin • Dec 26, 2019

Retirement isn’t what it used to be. Today, not only are people working, traveling and living dynamic lives well past the previous generation’s retirement age of 65, but saving for retirement requires a different mindset than your parents may have had. “In the past, many people had pensions, which would guarantee fixed income for life,” notes Don Dady, co-founder of Annexus, an independent designer of fixed-index annuities, or FIAs. “Today, people are living longer, healthier lives, and it’s very likely they may spend a third of their lives in retirement. This makes it important for people close to retirement to ask the question: How can I guarantee lifetime income, no matter how long my life might be?”

In the past, bonds served as the sole answer to this question for many people, functioning as a de-risking vehicle that could help guard retirement income against market fluctuations. And while bonds are still a solid way to de-risk a portfolio, exclusively relying on bonds may leave a portfolio vulnerable due to today’s historically low interest rates (as well as the possible negative valuation impact if interest rates were to rise in the near future). That’s where annuities come in as an option, says Roger Ibbotson, professor in the practice emeritus of finance at the Yale School of Management and chairman and CIO of Zebra Capital Management, who has researched annuities as part of the modern retirement portfolio.

An annuity is an insurance contract that can help protect and grow your retirement savings. There is a wide range of annuity options, each of which comes with unique features and benefits, making the landscape confusing. Many, though, fall under two major categories: fixed annuities, which offer set payments over a period of time (similar to a CD), and variable annuities, which offer payments based on performance.

A fixed-index annuity, or FIA, can be considered a hybrid of both, offering both a potential source of guaranteed income in retirement and a growth vehicle that may outperform bonds — without the risk of loss of the initial investment. “Annuities used to be cloaked in this black box of mistrust, but what we saw after the stock market crash of 2008 is that consumers really saw annuities as a viable fixed-income alternative,” explains Dady. In 2018, FIA sales set a new record of $69.6 billion, surpassing the previous 2016 high of $60.9 billion, according to the LIMRA Retirement Institute. “A fixed-index annuity can give you peace of mind, since the principal is guaranteed against market losses (subject, of course, to the claims-paying ability of the insurer). It also serves as a stable base of assets for an insurance company to offer a guaranteed future stream of income in retirement,” explains Ibbotson, “which may replace the pension-like cash that helped previous generations offset longevity risk.”

While returns are based on a market index, like the S&P 500, your money is never directly exposed to the market, which is why there is no risk you will lose your principal — but there is an opportunity you could benefit from interest earnings based on index gains. However, while a fixed-index annuity can be a smart addition to your portfolio, that doesn’t mean it’s appropriate for everyone. Here are some considerations to determine whether a fixed-index annuity is right for you.

You’re Approaching Pre-Retirement Age Or Are In Early Retirement

In your early career, you’re saving, building capital and managing risk. But as you near retirement, it may make sense to begin to actively de-risk your portfolio. “In general, people aged 50-75 could be an appropriate age bracket to consider fixed-index annuities,” says Ibbotson. Prior to 50, it may make sense to invest primarily in stocks due to their growth potential, as you should have time on your side for your portfolio to ride out market fluctuations. After 75, you may be drawing on financial capital and need more liquid income. (Contracts for FIAs vary, but many are five-plus years.) If you are approaching retirement, it may make sense to speak with a financial advisor to see if fixed-index annuities are the best path to achieving your financial goals.

You’ve Already De-risked Your Portfolio With Bonds

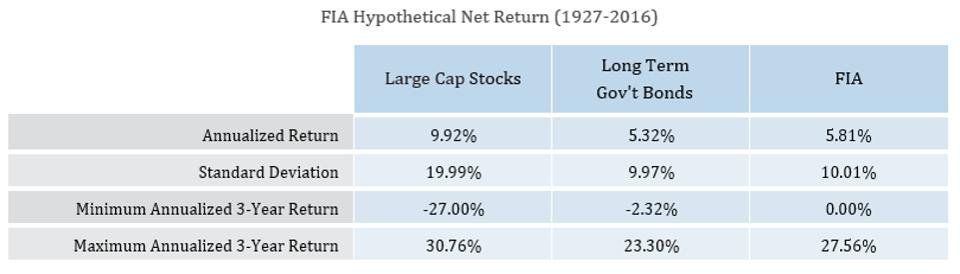

Bonds can be a great vehicle to de-risk your portfolio, but bond performance is vulnerable to market dips and rising interest rates. An FIA guarantees principal, and in research where Ibbotson compared the performance of large cap stocks, long-term government bonds and a simulated large-cap FIA over the period of 1927 to 2016, FIAs slightly outperformed bonds in average annualized returns with no risk of loss. That said, bonds, which can offer more liquidity to your portfolio, can also be valuable financial tools. While cases vary, in general, Ibbotson suggests that by around 65, individuals should consider investing about half of their portfolio in lower-risk, bond-like options.

FIXED INDEXED ANNUITIES: CONSIDER THE ALTERNATIVE” BY ROGER G. IBBOTSON, PHD*

“When you’re de-risking your portfolio for retirement, it makes sense to consider structuring your investments so there’s an increased probability of steady accumulation and payout. Talking with a trusted advisor can help you come up with a solution that’s right for you,” says Ibbotson. The advantage of having bonds in your portfolio alongside FIAs is that FIAs are designed for terms of five, seven or even 12 years, but individual contracts vary. In comparison, short-term bonds can mature in as little as one year. A bond ladder can also be structured to appreciate at different years, which may help give your portfolio yearly liquidity, while annuities can provide assurance of lifelong income over the long-term.

You Have Adequate Liquid Assets Or Liquid Income For The Next Decade

While FIA contracts vary, they are generally designed to be held over a long term. There are penalties for early-contract cancellations, potential fees and commissions built into the contract as well. Longer-term FIAs can be a good option for people who are confident in their liquidity and have other ways of generating income during the length of the FIA contract. Some contracts do allow partial withdrawals, which may provide enough yearly liquidity for your circumstances, and other contracts may allow withdrawals if the contract owner needs to go to a long-term care or nursing facility. Like all financial products, it’s important to read the fine print and understand exactly what you’re buying.

You’ve Maxed Out Other Retirement Options And Are Looking For Tax-Deferred Alternatives

As you look toward retirement and begin de-risking your portfolio, it’s a good idea to think about your portfolio as a whole and consider the role each element of your portfolio plays to help you meet both your retirement and legacy goals. “Fixed index annuities can provide equity participation with no risk of losing money to market volatility,” explains Ibbotson, who adds that annuities are especially helpful for guarding against longevity risk — the risk that you will outlive your assets. That said, it’s important to discuss your financial objectives with an advisor, both for the near and long-term, including plans you may have around financial gifting to families or institutions. For those looking to de-risk their portfolios, an FIA can be a good solution to get equity-like market exposure while guaranteeing an income stream in the future.

https://www.forbes.com/sites/impactpartners/2019/07/22/is-a-fixed-index-annuity-right-for-you/#197b474829b6

STFR does not provide Securities or Investment advice and any such advice required should be obtained from a qualified professional. STFR does not engage as a RIA or an IAR and does not offer stocks, bonds, mutual funds, stock advise, etc. as we are NOT securities licensed.

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy